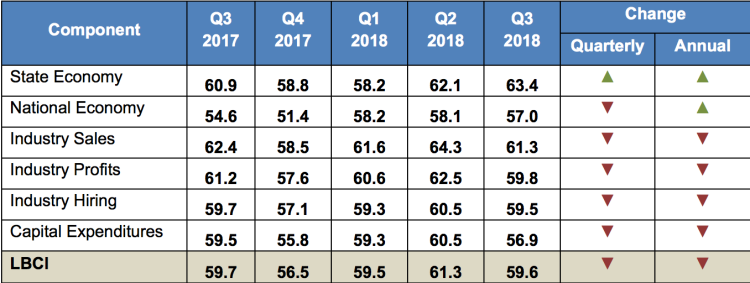

Colorado business leaders are losing some optimism about the economy for the rest of 2018. The latest Leeds Business Confidence Index (LBCI) released by the Leeds Business Research Division remains in positive territory, but optimism slipped for the national economy, industry sales, industry profits, industry hiring and capital expenditures looking to the third and fourth quarters.

Colorado business leaders are losing some optimism about the economy for the rest of 2018. The latest Leeds Business Confidence Index (LBCI) released by the Leeds Business Research Division remains in positive territory, but optimism slipped for the national economy, industry sales, industry profits, industry hiring and capital expenditures looking to the third and fourth quarters.

Panelists are, however, growing more positive about the Colorado economy, marking the third consecutive quarter of LBCI growth at the state level.

“The most recent data for Colorado, May over May, has 2.7 percent employment growth. So very strong growth and the survey reflects that,” said BRD Executive Director Richard Wobbekind. “Business leaders are seeing the strength of the economy, the growth in personal income, the growth in state output and they are reflecting that going forward.”

The Leeds Business Confidence Index measures Colorado business leaders’ optimism in six components: the state economy, the national economy, industry sales, industry profits, industry hiring and capital expenditures.

- Colorado business leaders are slightly less confident in the economy overall than they were last quarter, according to the Leeds Business Confidence Index.

- They continue to grow more confident about the state economy.

- Confidence remains positive across the board.

- Read the complete report.

- Learn more about the Business Research Division.

Capital expenditures saw the sharpest drop (roughly six percent), with more panelists saying they expect a moderate decrease in spending in the third and fourth quarters (10.4 percent and 17.9 percent, respectively). Most panelists said they expect no change in spending (more than 46 percent ahead of the third quarter).

“The less-bullish capital spending expectations could reflect some of the economic headwinds identified by panelists, including higher interest rates and trade concerns,” said Wobbekind.

Panelists cited concerns over labor shortages, affordable housing and trade policy as the top headwinds they anticipate facing going into the second half of 2018.

The primary concern, Wobbekind said, may be less about specific policy decisions, and more about uncertainty.

“They really want those policies clarified so they can make a decision based on reality,” said Wobbekind.